Oil prices fluctuated amid mounting concerns about the world economy.

On Tuesday, oil prices were uneven as poor global economic growth predictions stoked demand worries while easing investor worries about the US banking system with a takeover of the failed Silicon Valley Bank (SVB).

At 09:57 local time (06:57 GMT), the price of international benchmark Brent crude was $77.65 per barrel, down 0.14 percent from the previous trading session’s closing price of $77.76 per barrel.

American benchmark West Texas Intermediate (WTI), which completed the previous session at $72.81 per barrel, was trading at $72.95 per barrel at the same time.

Investors are still concentrating on the US financial crisis, the direction of the Chinese economy, and the forecast for oil demand.

The “lost decade” from now until 2030, according to the World Bank, is anticipated to see the lowest level of global economic growth in the past three decades.

According to a paper titled Falling Long-Term Growth Prospects: Trends, Expectations, and Policies, “the global economy’s-peed limit’—the maximum long-term rate at which it can grow without igniting inflation—is set to slump to a three-decade low by 2030.”

According to the bank, almost all of the economic factors that had fueled prosperity and advancement during the previous three decades were waning, which would cause a fall in the potential global gross domestic product (GDP) growth between 2022 and 2030.

The World Bank cautioned that “these declines would be much steeper in the event of a global financial crisis or a recession.”

Similar worries were also expressed by Kristalina Georgieva, managing director of the International Monetary Fund (IMF), who cited rising threats to financial stability at a time of significant market uncertainty.

After the US Federal Deposit Insurance Corporation announced Monday that the First Citizens Bank agreed to buy SVB’s deposits and loans, totaling about $72 billion of the failed bank’s assets, at a discount of $16.5 billion, prices saw some bullish support as concerns about the US financial crisis subsided.

Save/Share this story with QR CODE

Disclaimer

This article is for informational purposes only and does not constitute endorsement of any specific technologies or methodologies and financial advice or endorsement of any specific products or services.

Need to get in touch?

Need to get in touch?

We appreciate your reading.

1.)

Your DONATION will be used to fund and maintain NEXTGENDAY.com

Subscribers in the Philippines can make donations to mobile number 0917 906 3081, thru GCash.

3.)

4.)

AFFILIATE PARTNERS

World Class Nutritional Supplements - Buy Highest Quality Products, Purest Most Healthy Ingredients, Direct to your Door! Up to 90% OFF.

Join LiveGood Today - A company created to satisfy the world's most demanding leaders and entrepreneurs, with the best compensation plan today.

Business, Finance & Technology

Business, Finance & Technology

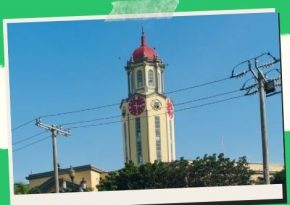

Manila cultural hub bus tours take off!

Manila cultural hub bus tours take off!