The pandemic isn’t harming homebuyers’ ability to pay, according to a real estate firm.

Clients of mid-range residential property developer Haus Talk, Inc. (HTI) have not been hampered in paying their amortization due to the pandemic, which has contributed to the company’s increased optimism in its operations.

HTI director and president Maria Rachel Madlambayan said in a virtual conference that the company is enthusiastic about its operations since it needs homebuyers to contribute 15 to 20% equity and is appraised based on their ability to make payments.

“Because our items come in such a wide variety of prices, we can be highly flexible.” As a result, we attempt to match their earnings to our products,” she explained.

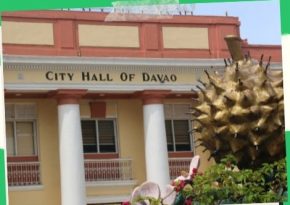

The company mostly sells houses and lots in Region 4 with prices ranging from PHP750,000 to PHP3.5 million.

Following its public listing on the Philippine Stock Exchange (PSE) on the small, medium, and emerging (SME) board, Madlambayan stated that they expect “exponential” development for the almost four-decade-old company.

With shares priced at PHP1.50 each, the firm raised PHP750 million.

Antipolo, Laguna, Marikina, and Metro Manila are among the cities where it currently has projects.

Madlambayan stated that additional initiatives will be launched this year.

Laguna, Antipolo, Quezon City, Mariveles, Bataan, and Calasiao, Pangasinan are among the locations for these projects.

“And we also have upcoming projects in extremely significant areas that are under discussion (to be launched) next year,” she added. “Right present, we’re in talks with a number of landowners in the Calabarzon and Central Luzon areas.”

Madlambayan stated that the company is concentrating on the middle market in order to help address the 6.5 million housing backlog in this category.

“We also have a social obligation to assist people by providing them with their own homes,” she added.

She said that the majority of the company’s clientele are overseas Filipino workers (OFWs) who are first-time homebuyers and that the majority of their real estate holdings were purchased with loans from big banks.

Save/Share this story with QR CODE

Disclaimer

This article is for informational purposes only and does not constitute endorsement of any specific technologies or methodologies and financial advice or endorsement of any specific products or services.

📩 Need to get in touch?

📩 Feel free to Contact NextGenDay.com for comments, suggestions, reviews, or anything else.

We appreciate your reading. 😊Simple Ways To Say Thanks & Support Us:

1.) ❤️GIVE A TIP. Send a small donation thru Paypal😊❤️

Your DONATION will be used to fund and maintain NEXTGENDAY.com

Subscribers in the Philippines can make donations to mobile number 0917 906 3081, thru GCash.

3.) 🛒 BUY or SIGN UP to our AFFILIATE PARTNERS.

4.) 👍 Give this news article a THUMBS UP, and Leave a Comment (at Least Five Words).

AFFILIATE PARTNERS

World Class Nutritional Supplements - Buy Highest Quality Products, Purest Most Healthy Ingredients, Direct to your Door! Up to 90% OFF.

Join LiveGood Today - A company created to satisfy the world's most demanding leaders and entrepreneurs, with the best compensation plan today.

Business Technology, Finance Technology & Information Technology

Business Technology, Finance Technology & Information Technology