DOF will repeal a rule that imposes a 12 percent VAT on exporter inputs

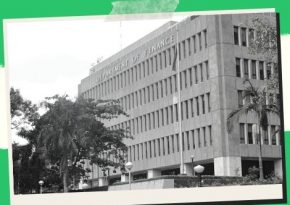

According to a House leader, the Department of Finance (DOF) and the Bureau of Internal Revenue (BIR) have decided to postpone the implementation of Revenue Regulation (RR) 9-2021, which levied a 12-percent VAT on some exporter transactions that were previously taxed at 0%.

The House Ways and Means Committee had a meeting with relevant government departments and stakeholders on Wednesday, which resulted in the suspension of the BIR rule.

The committee head, Albay Representative Joey Salceda, thanked Finance Secretary Carlos Dominguez III for this move, saying it would allow the country’s export sector to “receive the break it needs” to recuperate.

“Over the weekend, the DOF and the BIR met with me. We were scheduled to have a hearing on Monday, but we pushed it out to Wednesday to honor the Secretary’s decision to suspend the rule first until remedial legislation is drafted,” Salceda said.

RR No. 9-2021 was issued in accordance with Republic Act (RA) No. 10963, often known as the Tax Reform and Acceleration and Inclusion Act (TRAIN), which states that some transactions that were previously deemed zero-rated are now subject to a 12 percent VAT.

This is contingent on two criteria being met: the effective creation and operation of an improved VAT refund system and the complete payment in cash of all outstanding VAT refund claims as of December 31, 2017 by December 31, 2019.

The following transactions will return to zero-rated status as a result of the suspension decision:

Raw materials or packing materials are sold to a non-resident customer for delivery to a local export-oriented business.

Sale of raw materials or packaging materials to an export-oriented company whose yearly export sales surpass 70% of total output;

Those covered by Executive Order (EO) No. 226 or the Omnibus Investment Code of 1987, as well as other special legislation (Section 106 (A) (2) (a) (5) of the Internal Revenue Code, as modified);

Processing, producing, or repackaging products for other people conducting business outside the Philippines, and then exporting the items; and

Subcontractors and/or contractors’ services in processing, converting or producing products for a company whose export sales surpass 70% of total yearly output.

According to Salceda, the Department of Finance will put into effect a provision of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) law that allows exporters to get a VAT zero-rating on local purchases of goods and services that are directly and exclusively used in their registered project or activity.

“CREATE aims to make exporters’ lives easier, boost the country’s competitiveness, and promote material procurement from local sources. That is the legislation’s intent. That’s why it insists on a zero-rating for local inputs, in addition to increased deductions,” he said.

Salceda also said that he would continue to collaborate with the BIR and the Department of Finance to draft “corrective legislation” to resolve small exporter concerns about the refund system and audits.

“One problem with the audit system, according to the DOF, is that the Commission on Examine is also extremely rigorous with the refund system, which compels them to audit everyone who requests a refund. So, my suggestion is to loosen the regulations a little for minor de minimis claims, since it’s not worth the tax administration’s time,” he said.

Risk-based auditing, according to Salceda, is already the standard in most sophisticated tax countries.

“As a tourist, you travel to Japan or Singapore to buy certain things, and you can receive your VAT refund over the counter at the airport.” “Ideally, you want that system here as well,” Salceda said. “The Department of Finance seems committed to reforming our tax system and eliminating loopholes.”

He said that Congress is willing to collaborate with the executive branch to develop the laws needed to reform the system.

Save/Share this story with QR CODE

Disclaimer

This article is for informational purposes only and does not constitute endorsement of any specific technologies or methodologies and financial advice or endorsement of any specific products or services.

Need to get in touch?

Need to get in touch?

We appreciate your reading.

1.)

Your DONATION will be used to fund and maintain NEXTGENDAY.com

Subscribers in the Philippines can make donations to mobile number 0917 906 3081, thru GCash.

3.)

4.)

AFFILIATE PARTNERS

World Class Nutritional Supplements - Buy Highest Quality Products, Purest Most Healthy Ingredients, Direct to your Door! Up to 90% OFF.

Join LiveGood Today - A company created to satisfy the world's most demanding leaders and entrepreneurs, with the best compensation plan today.

Business, Finance & Technology

Business, Finance & Technology